Amid inflation prices Americans turn to DIY home improvement projects

As large home prices and mortgage loan costs force many owners to remain set instead than trade-up, a whopping 90{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of homeowners are looking to make their current residing space more relaxed this yr, according to a new study.

But as inflation continues to push up material prices, many are turning to Do it yourself assignments to conserve dollars.

For occasion, even though the consumer-selling price index, a measure of inflation, moderated to 6.4{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} in January from a 12 months before, the expense of ground coverings rose 13.1{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f}, and the rates of tools, hardware and provides went up by 11.8 {dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f}, in accordance to facts introduced previously this 7 days by the Labor Department.

How are homeowners managing mounting expenses of residence advancement projects?

In a study of approximately 3,700 American owners by Today’s Homeowner, nearly 28{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of respondents mentioned they were setting up to devote “significantly” a lot less when compared to last calendar year, 90{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of property owners explained they ended up organizing to tackle at least one particular home renovation challenge this 12 months.

“If you needed to get new home furnishings or if you desired to paint your residence, or if you wished to place new siding up exterior, if you needed to develop a deck, really everything similar to enhancing your dwelling, we located that this category, was about 10{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} far more expensive,” Hailey Neff, a researcher on the study instructed United states Currently. “For a large amount of house owners, DIY task has become a much more more cost-effective way of performing it.”

House owners in some states are tightening their purse strings more than other folks. A lot more than 60{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of home owners in four states (Connecticut, Wisconsin, New Mexico, and Nebraska), 60{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} claimed they system to cut down their paying on home improvement initiatives in 2023.

With these initiatives, quite a few property owners are commonly looking to enhance their dwelling place. Just about 69{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of respondents list this as a major cause for seeking to comprehensive their planned house advancement projects in 2023. The next-most well known reason for wanting to comprehensive one particular or more renovations is to resolve a little something damaged (53.1{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of respondents).

Only about 13{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of owners checklist renovations prior to listing a property for sale as a person of their major factors for using on improvement projects.

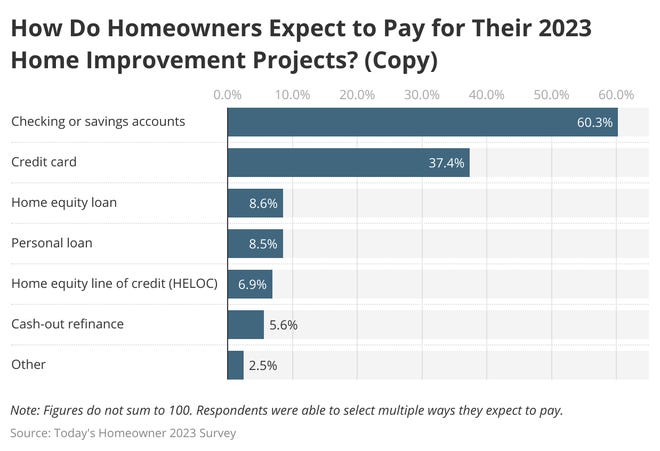

How are homeowners paying for property advancement initiatives?

About 60{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of respondents claimed they hope to pay out for assignments using money from checking and discounts accounts (60{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f}). In addition, 37{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of homeowners cite credit score playing cards as a single of the approaches they will fork out for advancement tasks.

Less owners assume to switch to financing alternatives, and of those, virtually 9{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} report house fairness and private loansas their preferred decisions.

Due to volatile and elevated property finance loan costs, fewer householders are fascinated in a dwelling fairness line of credit (HELOC) or dollars-out refinancing as techniques to fund their property advancement. In a HELOC, fascination prices are usually variable, this means that house owners could be on the hook to pay out a larger rate if desire prices proceed to increase. In the meantime, a hard cash-out refinance is only valuable when present house loan costs are decrease than the current fee, which could not be the scenario for several householders these days, according to Today’s House owner.

Do it yourself your property enhancement project?

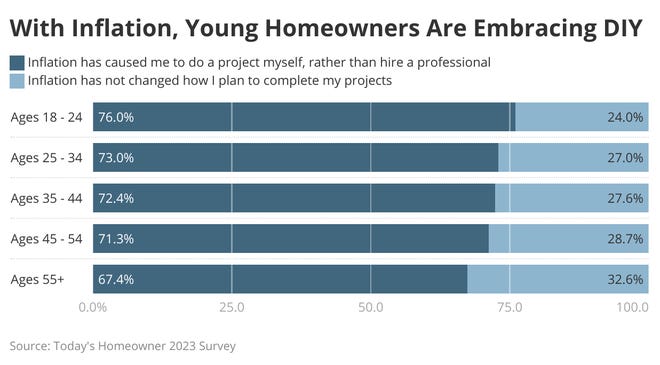

About 71{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of house owners say that inflation has brought on them to do a venture by themselves rather than employ a qualified.

The trend is even more pronounced for Gen Z and Millennials. Approximately 76{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f} of householders amongst the ages of 18 and 24 are performing a task on their own relatively than employing a contractor due to inflation. For people less than 44, that quantity is shut to 73{dd3cf16dc48cbccde1cb5083e00e749fe70e501950bc2e0dea1feff25a82382f}.

The survey also found that owners in remote areas appear to be to choose Do it yourself, most likely indicating a difficulty in finding nearby experts. Eight of the best 10 states with the most Do-it-yourself-leaning property owners in this analyze have a inhabitants of five million or fewer.

Swapna Venugopal Ramaswamy is a housing and financial system correspondent for United states of america Nowadays. You can follow her on Twitter @SwapnaVenugopal and indication up for our Daily Money newsletter here.